Return Inwards in Trial Balance

Trial balance is a summary of all the ledger accounts balances presented in a. Does return inwards go on the balance sheet.

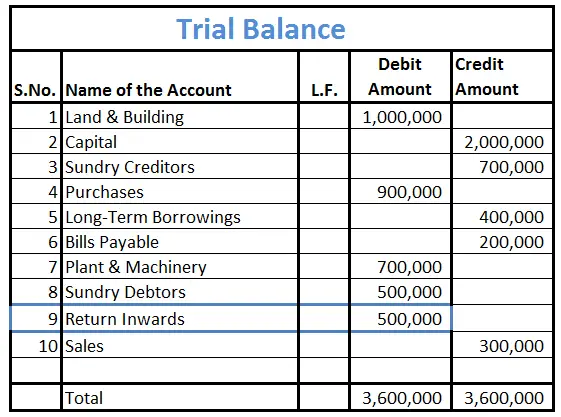

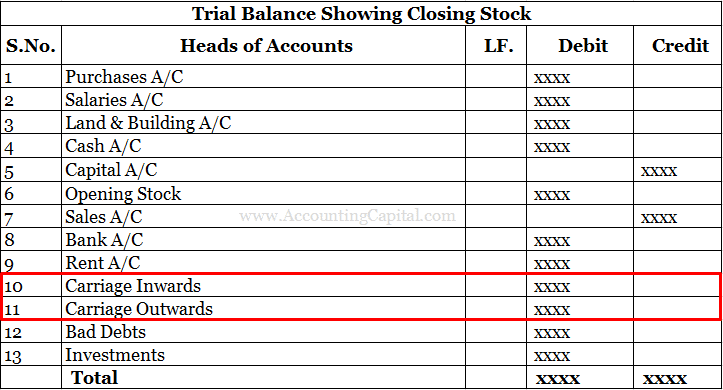

How Is Return Inwards Treated In Trial Balance Accounting Capital

Return inwards is the flow of goods in the business which were sold.

. Returns Inwards are items returned TO the company leading to a reduction Cr in Receivable or Cash and an Increase Dr in a. Goods bought are returned to the suppliers. Wages and Salaries Rent.

It is deducted from the sales balance to show the actual position of the firm and deduct the amount which is returned as it is. Return inwards is recorded in the books of accounts of the seller. Return outwards holds credit balance and is placed on the credit side of the trial.

Reduces the sum from the. Return inwards is the flow of goods in the business which were sold. Return inwards is recorded in the books of accounts of the seller.

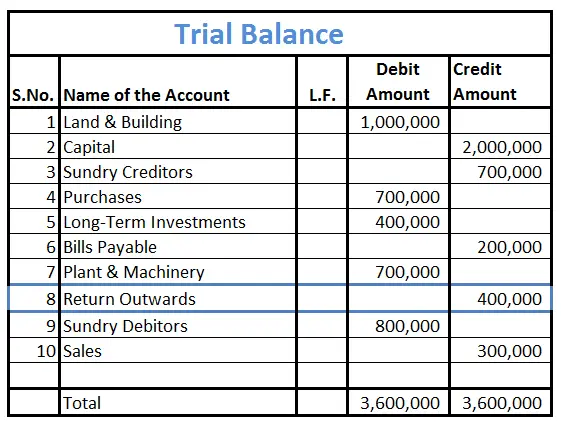

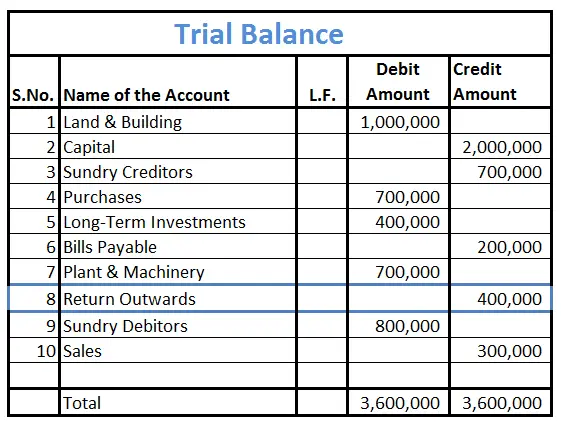

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. ABC company sells 10000 units of goods at 10 per. It is treated as a contra-expense transaction.

Goods sold to the buyer are returned by them. Return outwards is recorded in the books of accounts of the buyer. Return Inward in the Trial Balance are deducted from A.

Returns inwards do not necessarily result in a reduction of the cost of goods sold since goods that were returned might not necessarily have been sold to third parties. Return inwards is the flow of goods in the business which were sold. It is deducted from the sales balance to show the actual position of the firm and.

What is return inwards in trial balance. Return outwards is recorded in the books of accounts of the buyer. Return inward is the contra account of the sale account on income statement so it will deduct the sale balance during the period.

What is a Trial Balance. Where does return outwards go in balance sheet. Trial balance isa An accountb A statementc A subsidiary bookd A principal book.

Where does return outwards go in balance sheet. Where does return inwards and outwards go in the trial balance. It is deducted from the sales balance to show the actual position of the firm and deduct the amount which is returned as it is.

The accounts reflected on a. A trial balance is prepared to check the arithmetical accuracy of the double entries made in the ledger and as a basis to prepare financial statements. Return inwards is the flow of goods in the business which were sold.

It is deducted from the sales balance to show the actual position of the firm and deduct the amount which is returned as it is.

How Is Return Outwards Treated In Trial Balance Accounting Capital

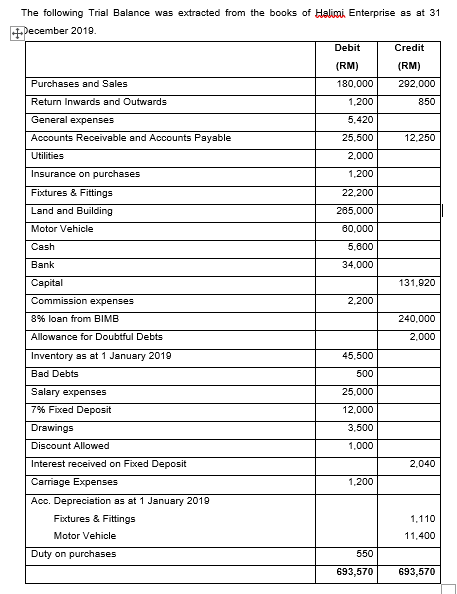

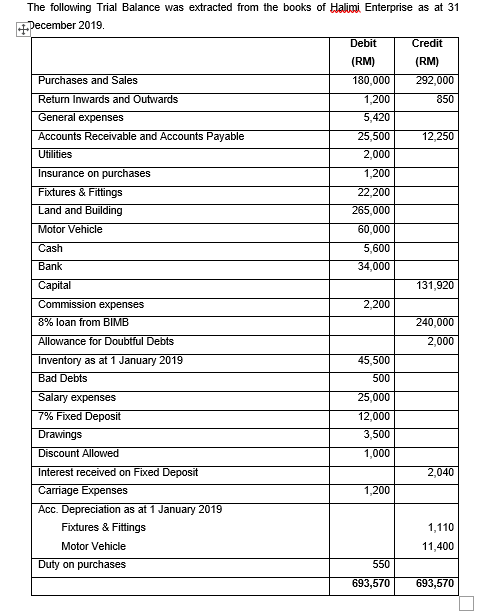

Solved The Following Trial Balance Was Extracted From The Chegg Com

Carriage Outwards Carriage Inwards In Trial Balance Accounting Capital

What Are Return Inwards Example Journal Entry Accounting Capital

The Following Trial Balance Was Extracted From The Chegg Com

0 Response to "Return Inwards in Trial Balance"

Post a Comment